REMYA NAIR

Pakistan has reserves for just two months of imports, and also faces a current account, fiscal deficit, inflation crisis.

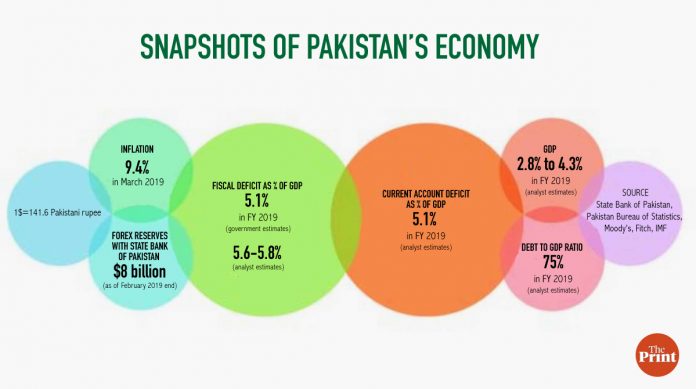

Pakistan’s economy has been in a free fall for long but things are only getting worse — its current account and fiscal deficit is widening, inflation is rising, it’s facing a ballooning external debt and the foreign exchange reserves are dwindling. In short, it’s a serious crisis.

In its World Economic Outlook report released Tuesday, the International Monetary Fund (IMF) revised downwards its growth projections for Pakistan to 2.8 per cent for 2018-19 and 2.9 per cent for 2019-20. It cited “ongoing macroeconomic adjustment challenges” for its revised projections.

The report comes even as Prime Minister Imran Khan-led government rushes to complete negotiations with the IMF for a bailout.

With its rising fuel import bill following a devaluation of the Pakistani rupee and a downgrade in the sovereign rating by rating agencies, Pakistan’s dependence on international assistance, especially bilateral help from countries like the United Arab Emirates (UAE), Saudi Arabia and China, has been continuously rising.

As of end February 2019, Pakistan’s foreign exchange reserves stood at more than $8 billion — adequate to service around 2 months of imports — as against over $12 billion just a year ago.

The Pakistani rupee has also depreciated by nearly 40 per cent against the dollar in the last two years as international pressure forced the Pakistani central bank, State Bank of Pakistan, to allow the rupee to devalue — it was trading at around 141 to a dollar Wednesday, nearly half the value of the Indian currency.

Put next to a subdued economic growth, all these factors are exerting pressure on the Imran Khan government to bring in structural reforms to check its twin deficit issue as well as complete its negotiations with the IMF at the earliest to provide certainty to the markets.

Fiscal deficit issue

In the last four months, the ratings agencies too have downgraded the sovereign rating of Pakistan.

Fitch expects Pakistan’s fiscal and current account deficit to be at 5.6 per cent and 5.1 per cent of GDP respectively in 2018-19 (financial year ending June).

In its statement supporting the rating downgrade to non-investment grade ‘B-’ from ‘B’ in December, Fitch had said, “The downgrade reflects heightened external financing risk from low reserves and elevated external debt repayments, as well as a continued deterioration in the fiscal position, with a rising debt/GDP ratio.

“A successful conclusion of ongoing negotiations on IMF support could help stabilise external finances, but the programme would then face significant implementation risk.”

Fitch had also flagged the rising debt to GDP ratio, which is expected to cross 75 per cent of GDP by end 2018-19, as well as the rapid increase in external borrowings.

The Imran Khan government had estimated to bring down the fiscal deficit to 5.1 per cent of GDP in FY19 from 6.6 per cent in the previous fiscal.

While announcing its rating action in February, Standard and Poor’s (S&P) had flagged the risks to growth citing “diminishing stimulatory impact of the investments associated with the CPEC (China Pakistan Economic Corridor), negative fiscal impulse as the government looks to rein in its deficit, and declining economic sentiment”.

“Growth will also be constrained by domestic security challenges and long-lasting hostility with neighbouring India and Afghanistan,” S&P had added.

Another rating agency, Moody’s, in its credit opinion for Pakistan dated 22 March, highlighted the heightened external vulnerability risk.

“Foreign exchange reserves have fallen to low levels and, absent significant capital inflows, will not be replenished over the next 12-18 months. Low reserve adequacy threatens continued access to external financing at moderate costs, in turn potentially raising government liquidity risks,” it said.

‘Pure politics’

Speaking to ThePrint, Ashfaque Hasan Khan, a member of the Economic Advisory Council (EAC) to PM Khan said the fiscal deficit has always been a problem for Pakistan and this is contributing to the current account deficit.

However, he disagreed with the government over the need to seek assistance from the IMF.

“The government had already planned in their mind that they will go to the IMF. They made only a half-hearted attempt to correct the balance of payments gap,” he said, adding that the foreign exchange reserves with Pakistan are adequate to meet its import requirements.

But Khan attributed the series of rating downgrades and downward revision in growth outlook as “pure politics”.

Abid Qaiyum Suleri, another EAC member, said the balance of payment and forex for current fiscal year have been arranged.

“However, going to IMF will be important for next fiscal year’s balance of payment,” he said.

Both the current account deficit and fiscal deficit have been curtailed and are lower than last year, said Suleri.

“However, structural issues of economy (especially energy circular debt and loss making public sector units) need to be addressed either within or outside IMF umbrella.”

No comments:

Post a Comment