The country sits atop oil, gas and mineral deposits that could be worth a trillion dollars. But building a commercial mining industry will be a rocky road.

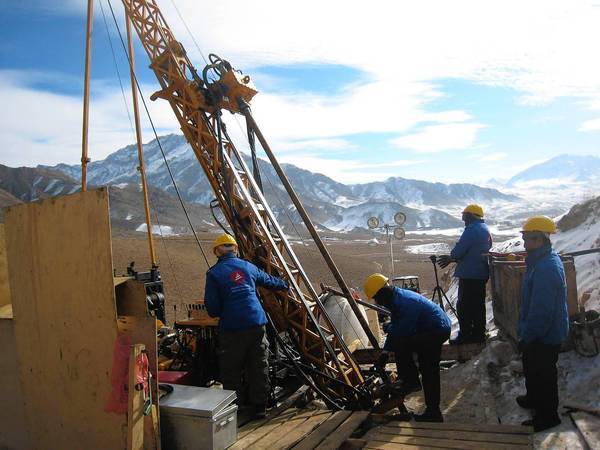

In a rugged valley outside Kabul, where mud-walled villages blend into bare scrubland, a team of international mining experts and Afghan trainees set up camp over the winter to probe the region's mineral resources.

Protected by armed guards, they spent three months drilling test holes into the snowcapped peaks, as curious goat- and sheepherders looked on.

"We hit copper damn near everywhere," said Robert Miller, a Colorado-based mining executive recruited by the Pentagon to help advise Afghan authorities on how to develop the country's natural resources. "It's a very encouraging finding."

Studies have found that Afghanistan, one of the world's poorest and most war-torn countries, sits atop hydrocarbon and mineral deposits that could be worth more than a trillion dollars. The Afghan government and its U.S. backers are counting on this largely untapped wealth — including oil, gas, copper, iron, gold and lithium — to bring in cash and create jobs as international assistance begins to wind down.

"Afghanistan needs to develop its geology," said Najibullah Rochi, a 24-year-old geophysicist with the Afghanistan Geological Survey who was getting his first field experience at the Taghar deposit in what is known as the North Aynak mineral zone. "We need jobs and salaries. This is the way."

But industry experts caution that it will take many years and billions of dollars to build the power plants, railway lines and other infrastructure needed to extract and transport commodities from the country's mountainous terrain. Moreover, many of the mineral deposits are in the south and east of Afghanistan, where the Islamist insurgency is strongest.

Afghanistan's first attempts to develop a modern mining industry have been plagued by security threats and rumors of corruption, underscoring the difficulty the country is likely to face in unlocking its mineral riches.

Miller said he had no doubt about the country's potential.

"In my opinion, Afghanistan could replace Chile as the largest exporter of copper," he said. "Can they put it together? That's the trillion-dollar question."

Managed poorly, Afghanistan's mineral riches could instead become a source of more conflict and graft, another example of the "resource curse" that has afflicted countries such as Angola, Cambodia and Democratic Republic of Congo.

The World Bank estimates that 97% of Afghanistan's economy is tied to international military and donor spending. Although the United States and other major donors have pledged not to abandon the country, they are tired of government corruption and have economic difficulties of their own. Support for Afghanistan could fall sharply after most foreign forces leave by the end of next year.

Afghanistan's natural resources appear to represent the country's best hope for self-sufficiency. A report prepared by the Pentagon in 2010, based on research by the U.S. Geological Survey, identified mineral and oil reserves worth nearly $1 trillion. Afghan authorities called that estimate conservative and put the figure at $3 trillion.

They hope to sell the development rights to many of the deposits to international mining companies.

A $3-billion agreement was reached in 2008 with a Chinese consortium to develop a copper deposit in Logar province, south of Taghar. Negotiations are underway with companies in India and Canada for rights to one of the world's largest iron ore deposits, in Bamian province. The government is also completing contracts for major copper, gold and oil concessions.

Wahidullah Shahrani, Afghanistan's minister of mines, said the mining and petroleum sectors could bring in as much as $1.5 billion in annual government revenue, create 150,000 jobs and contribute $5 billion to the economy annually by 2016.

"Not in your wildest dreams," Miller said; it could take 10 to 15 years for major projects to be readied.

Afghans have engaged in small-scale "artisanal" mining for centuries, but the country does not have large commercial operations.

Major construction has not started at the Mes Aynak deposit south of Taghar, a joint venture by the state-run China Metallurgical Group Corp., or MCC, and Jiangxi Copper Co. The site holds ancient Buddhist ruins and artifacts. Archaeologists were given until the end of last year to salvage what they could. But in an interview with The Times, Shahrani said mining would not be allowed to begin until he received clearance from the Ministry of Information and Culture, which he expects by May.

Another reason for the delay is that several villages must be relocated, MCC said in its latest earnings report.

Last month, the government celebrated the completion of a mosque, schools and other infrastructure at a planned relocation site for displaced villagers. But Mullah Sharbat Ahmadzai, a local elder who sits on a community advisory council for the project, said residents who vacated their homes years ago were still waiting for jobs and for land to rebuild on. Now others don't want to cooperate.

"Neither the villagers around the mine site nor the government are benefiting from the project," he said.

Security has also been a problem. Land mines had to be cleared, and last summer the consortium suspended work after about 150 Chinese employees fled insurgent rocket attacks. Shahrani said authorities then increased the number of security personnel and the workers returned.

Construction hasn't begun on key support infrastructure, including a railway line and a coal-fired power plant. In the meantime, as many as 5,000 Afghans are out of work because authorities last summer put a stop to informal coal mining in Bamian's Kahmard district to make way for the Chinese venture, said the provincial governor, Habiba Sarabi.

Frustration over the lack of work and coal — used here for cooking and heating during the winter — may have contributed to a rise in militant attacks last year, Sarabi said. But she said security had improved since authorities increased the number of Afghan army patrols and checkpoints in the area.

Shahrani said the central government would not tolerate illegal mining, because of health, safety and environmental concerns, as well as the use of child labor. But he said authorities were developing a policy framework that would permit some artisanal mining.

He said he expected production at Mes Aynak to begin in 2014. But some Western advisors privately question whether the Chinese companies may be holding back because of concern about the withdrawal of foreign troops and unfavorable market conditions. Company officials did not respond to requests for comment.

So far, major Western mining firms have shown limited interest in Afghanistan. Some have complained about high royalty fees. There is also concern about the country's mining law, which does not guarantee companies the right to develop deposits they explore. Revisions aimed at reassuring foreign investors stalled last summer over Cabinet objections that the changes did not protect the country's interests. Shahrani said he expected a new law to be passed this year.

Investors also worry about Afghan corruption. Shahrani's predecessor was sidelined after news reports alleged that he had accepted a $30-million bribe for the Mes Aynak tender, an accusation he denied.

Questions were also raised about a northern oil concession awarded to China National Petroleum Corp. and Watan Group, an Afghan company with connections to President Hamid Karzai's family. Critics included Abdul Rashid Dostum, a former warlord whose supporters were accused by government officials of intimidating Chinese workers and demanding kickbacks. A statement issued by Karzai's office said U.S. and British experts audited the tender and found the process was fair.

"All the necessary measures have been taken to make sure that our deals are clean, transparent, auditable, and they will be in line with international practices," Shahrani said.

Afghanistan signed up for the Extractive Industries Transparency Initiative, an international effort that aims to improve governance in resource-rich countries by publishing payments made by oil, natural gas and mining companies. Last year, the government published more than 200 mining and energy contracts on the Ministry of Mines website.

Juman Kubba, a researcher with the London-based watchdog group Global Witness, welcomed the steps but said more safeguards were needed.

"One of our concerns is that the Aynak contract still has not been published. So who is going to check it's actually being implemented?" she said. "There are so many international lessons of what can go wrong."

No comments:

Post a Comment